Firefly Aerospace has filed to go public under the ticker $FLY, marking a bold move into the public markets as it aims to compete with private and public players in the space launch industry. While the IPO date hasn’t been announced yet, investors are already taking notice—especially those keeping an eye on emerging space stocks.

Firefly Aerospace vs. Rocket Lab: A Growing Rivalry

Firefly positions itself as a direct competitor to Rocket Lab ($RKLB), targeting the small-to-medium lift launch market with its Alpha rocket. The company is also diversifying into lunar lander technology (via its Blue Ghost program, which is backed by NASA) and broader aerospace and defense contracts. These developments give Firefly a multi-stream approach to revenue, if execution can follow.

🚨 Track Record: 6 Launches, 2 Full Successes

As someone who’s been following Firefly for a few years, I’m cautious. Of their six launches, only two have been fully successful. In the high-stakes world of commercial spaceflight, reliability is non-negotiable. For comparison, Rocket Lab has launched over 40 times and still battles reliability concerns from investors.

📉 Concerns: Cash Burn and Debt

What worries me more than the rockets is the financial structure. Firefly’s cash burn rate and debt levels are aggressive for a company still proving its core services. Unless they tighten up their R&D spending and improve financial transparency, I don’t see a long-term position making sense. (Of course, that’s easier said than done in a capital-intensive industry like this.)

💸 Valuation: Will $FLY Stock Be Overpriced?

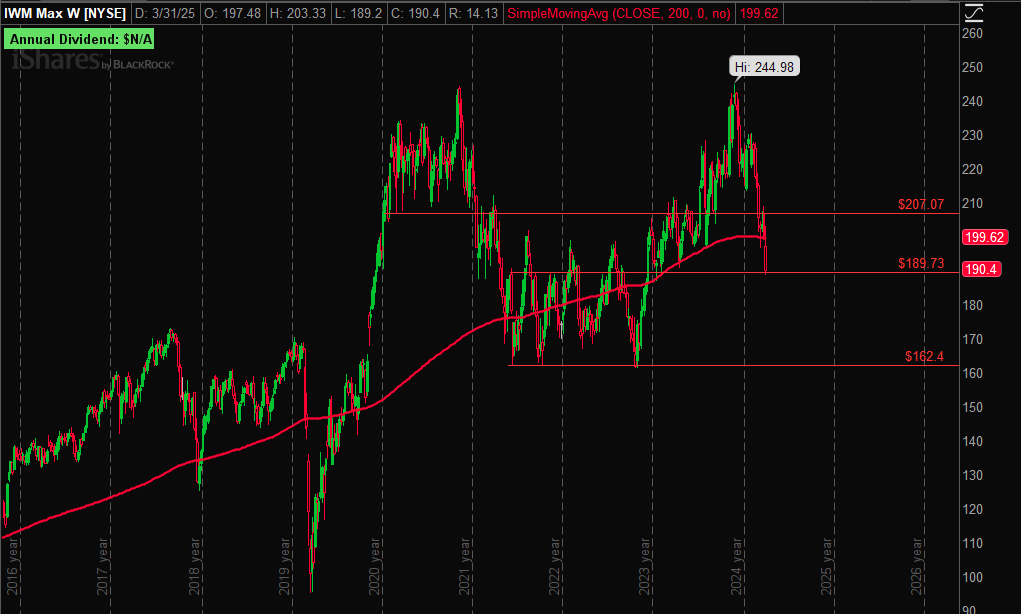

Let’s talk numbers. Given the hype around IPOs lately—especially in tech and space—I wouldn’t be surprised to see Firefly’s IPO priced above $20 per share. Personally, I’d need to see it under $10 to even consider investing at this early stage. At that price, the risk-reward balance starts to look more interesting for speculative investors.

🔍 Final Thoughts: Worth Watching, But Not Jumping In (Yet)

Firefly Aerospace is an exciting player in a fast-evolving industry. The commercial space sector is projected to grow massively over the next decade, and companies like Firefly could capture meaningful market share. But with a shaky launch success rate, unclear profit path, and rising competition from SpaceX, Blue Origin, and Rocket Lab, it’s too early for me to go long.

If you’re into speculative investing, $FLY is worth tracking—but only if the IPO price makes sense.